[ad_1]

PAN Card The deadline for linking with Aadhaar has expired on June 30, 2023. Those who within this time limit Aadhaar card to PAN card have not been able to link to, now their pan card inactive It is done. Since PAN card is important for banking and finance related transactions, as long as your PAN is inoperative, you will not be able to carry out financial transactions or file your income tax return. Although PAN card reactivated to do Many methods exist. Know here…

In this article:

How to reactivate deactivated PAN card

The Government of India has suggested several methods with the help of which users can Inoperative PAN Card Can be activated again. There are online and offline methods for this. One way is in which you have to link PAN-Aadhaar by paying a fine, while the other way is in which you have to send a letter to the Assessing Officer. If you have already applied for linking your Aadhaar and PAN card but haven't done so yet.

Activate PAN card by paying the challan

If you have not been able to link your Aadhaar and PAN card within the time limit, then as per the guidelines given by the government, you will have to pay a fine of Rs 1000 while linking your PAN with your Aadhaar card to activate your PAN card. have to give. Let us first know the PAN card linking status…

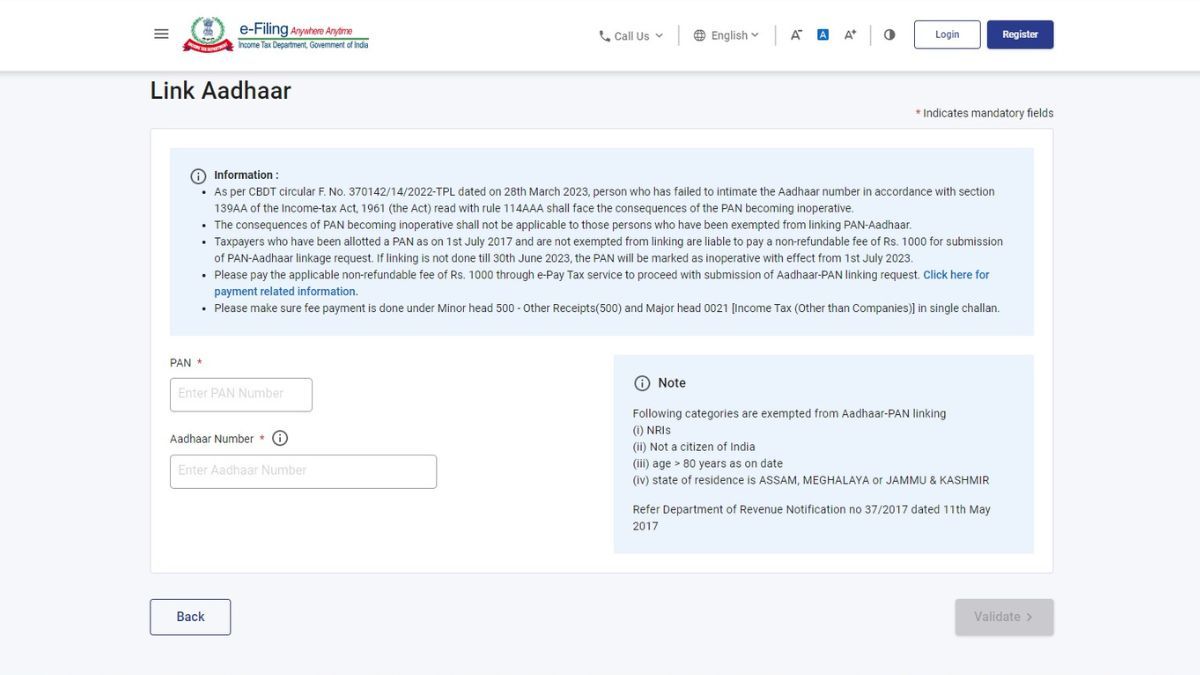

step 1: To check Aadhar Card and PAN Card linking status, first go to Income Tax Portal (https://eportal.incometax.gov.in/iec/foservices/#/pre-login/bl-link-aadhaar) go to.

Step-2: Now enter your PAN and Aadhar card number.

Step-3: After this, click on Validate at the bottom right side of the screen.

Step-4: If you have already linked your Aadhar card with PAN card, it will pop up showing you that you have already linked.

Step-5: If you have not yet linked your Aadhaar and PAN card, this will go ahead.

How to link PAN-Aadhaar by paying challan

If your PAN-Aadhaar card is not linked, then you can link it by paying the challan. For this the following steps have to be followed:

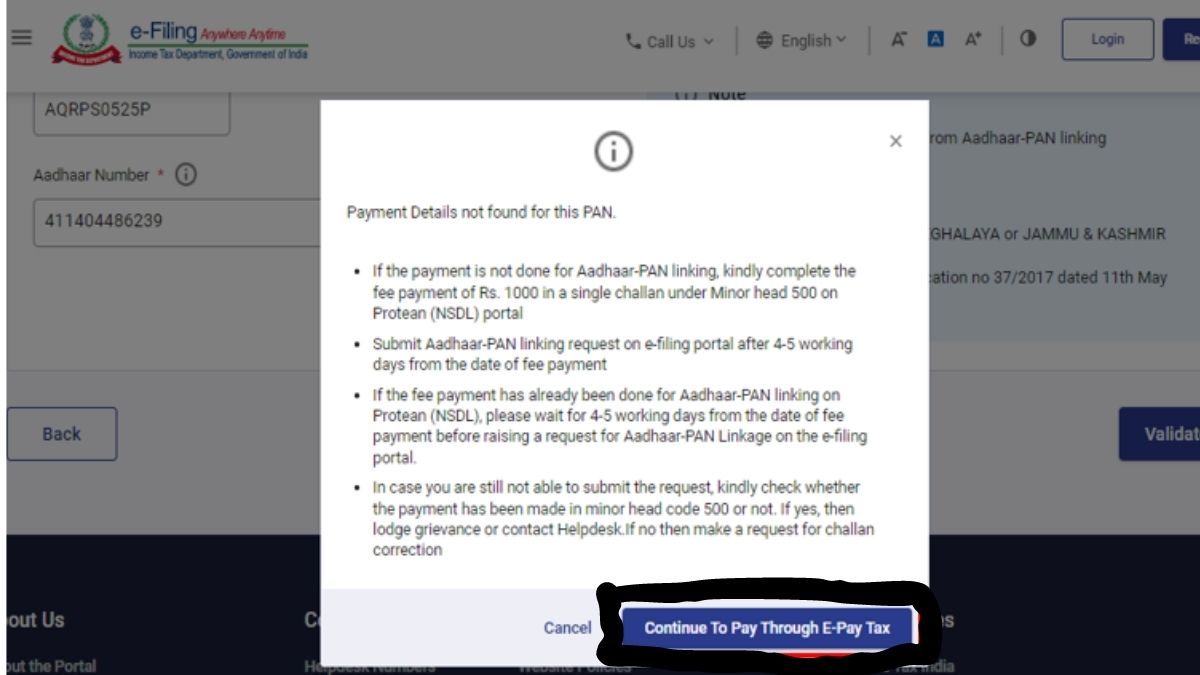

step 1: For this you will have to click on Continue to pay through E-Pay tax.

Step-2: Then enter your PAN number and confirm it.

Step-3: After this enter your mobile number linked to your PAN card.

Step-4: Once you get the OTP, enter it on the next screen and proceed.

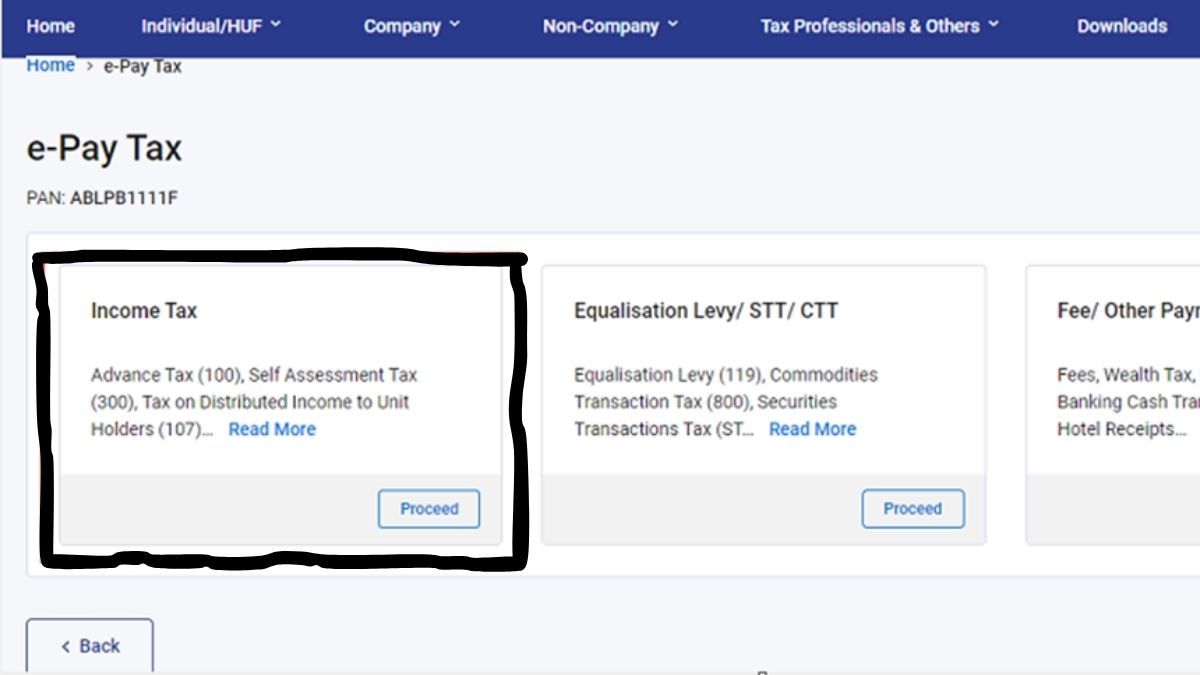

Step-5: Now click on Continue and select proceed under Income Tax bracket.

Step-6: In the assessment year you have to choose 2022-23.

Step-7: In payment, select other payment option.

(For adults it is Rs 1000, while for minors aged 16 to 18 years it is Rs 500)

Step-8: Then you have to click on Continue.

Step-9: Now here you can make payment using UPI, credit card, debit card and direct transfer.

How to make offline payment through bank

step 1: For this, Income Tax Portal (https://eportal.incometax.gov.in/iec/foservices/#/pre-login/bl-link-aadhaar) go to.

Step-2: Enter your PAN and Aadhar card number, then click on Validate.

Step-3: Verify through OTP, then click on Continue.

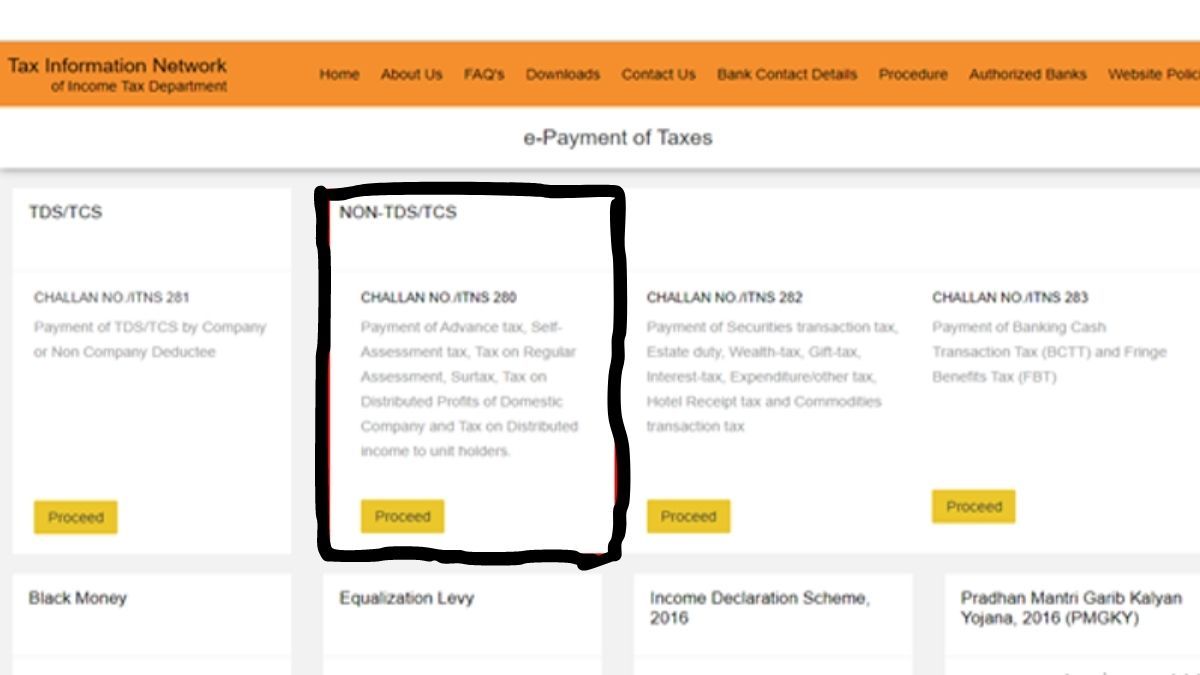

Step-4: Click on Proceed inside the “NON-TDS/TCS” bracket on the screen during payment.

Step-5: Here select Income Tax (Other than Companies).

Step-6: Then you have to select the Other Receipts option in the Type of Payment option.

Step-7: Here choose the debit card payment option and select your bank.

Step-8: After this you will have to fill the form visible on the screen. Then take its print.

Step-9: Take the printed copy to the bank and make the payment within the next 3 working days.

How to write a letter to the Assessing Officer

If you have already applied for linking your PAN card with Aadhaar card and your PAN card has become inactive due to the pending process, you can write a letter to the Assessing Officer. Along with the letter, attach the copy of Aadhaar card, receipt received during the PAN-Aadhaar linking application and other necessary documents.

question Answer

How to protect PAN card from becoming inactive?

If you want your PAN card to remain functional, you must file your income tax return on time every year and keep your Aadhaar card linked to your PAN and updated.

Do I need to get a new PAN card if the PAN card becomes inoperative?

No, you can write a letter to your assessing officer to activate it after paying the prescribed dues and late fees.

If my PAN card gets deactivated, will my PAN number change?

No, the PAN number remains the same for the entire lifetime after it is issued.

How will I know that my PAN has been restarted?

For this you will have to login to the official income tax portal. Log in using your PAN card. Then go to My Profile section. There you can see the status of your PAN card.

[ad_2]