[ad_1]

If you want to get pension after retirement, then Atal Pension Yojana (Atal Pension Scheme, ‘APY’) can be a good idea. The main objective of this scheme is to provide pension facility after retirement to the people working in the unorganized sector. Monthly contribution has to be made under APY, then 60 years of age After 1000 to 5000 Monthly pension facility up to Rs. you too Atal Pension Yojana (APY) If you want to invest in, then let us know about it in detail…

In this article:

Atal Pension Scheme 2023

| name of the scheme | Atal Pension Scheme |

| start of plan | By Central Government (Year 2015) |

| beneficiary | People working in unorganized sectors of the country |

| Objective | Monthly pension facility |

| age | 18-40 years |

| Minimum investment period | 21 years |

| Minimum Monthly Contribution | 42 rupees |

| maximum monthly pension | 5000 rupees |

| CRA number | 1800-222-080 |

| NPS Helpdesk | 1800-110-708 |

| website | https://www.india.gov.in/spotlight/atal-pension-yojana |

How to apply online for APY

There are two ways to open APY account in bank or post office.

First method: before that bank or post office Go to the branch where you have your savings bank account. duly filled in to the bank or post office apy application form must be deposited and KYC The process will also have to be completed.

Second method: you of your bank net banking online also by using the facility apy account Can open. State Bank of India, ICICI Bank Banks like etc. allow customers to open Atal Pension Yojana account through internet banking facility. Facility to open APY account through SBI net banking ‘e-services’ In the tab, it is under the option of Social Security Scheme.

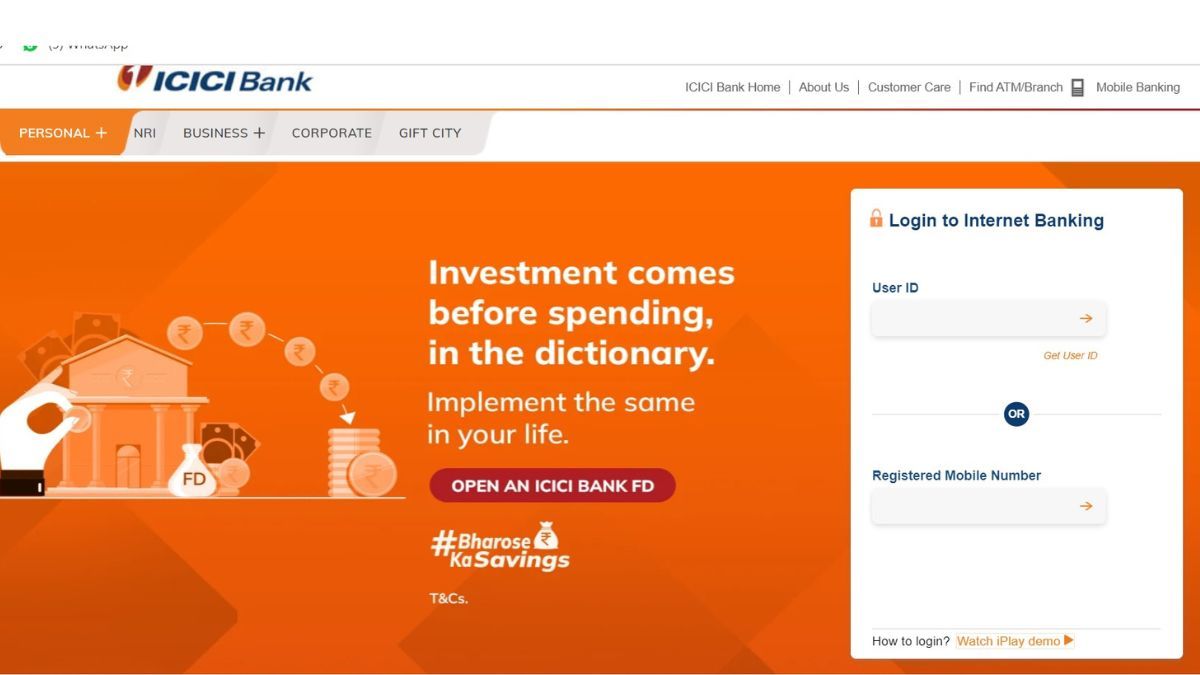

For example, if your savings account ICICI in the bank and Atal Pension Scheme If you want to apply online then you can follow the steps given below:

step 1: ICICIBank.com after visiting log in Do it.

Step-2: then you here ‘Customer Service’ Have to click on.

Step-3:here again ‘Service Request’ Click on.

Step-4: after this ‘Bank Account’ from section Enroll for Atal Pension Yojana Click on.

Step-5: Now you have to enter all the required details.

Step-6: After this, the Atal Pension Yojana account will be activated within one working day. Also, auto debit will start automatically.

What is Atal Pension Yojana (APY)?

Atal Pension Yojana (APY) is a government pension scheme, whose main objective is to provide social security to all the people.

- this especially Poor, deprived and unorganized sector Is for people working in. Employees working in the private sector or working with organizations who do not get pension benefits can also apply for this scheme.

- under this scheme 60 years after the age of Rs 1000, Rs 2000, Rs 3000, Rs 4000 or Rs 5000 There is an option to get a fixed pension of Rs.

- Pension is determined based on the person’s age and contribution amount. contributor’s Pension on death of spouse contributor Can claim. Whereas on the death of both the subscriber and his/her spouse, the nominee will receive the accumulated amount.

- If the subscriber 60 years If the deceased dies before completing the age of 50 years, the spouse can either exit the scheme and claim the corpus or continue the scheme for the remaining term.

- Management of the amount collected under the scheme, as per the investment pattern prescribed by the Government of India. Pension Fund Regulatory Authority of India (PFRDA) Done through.

Government also contributes to APY

In this scheme, the Government of India will also co-contribute 50 percent of the customer’s contribution, which is Rs 1,000 per year or less. However, government co-contribution is available only to those who are not covered under any statutory social security scheme and are not income tax payers.

Let us tell you that the Government of India will make co-contribution for a period of 5 years only in the accounts of those eligible customers who had joined the scheme during the period from June 1, 2015 to March 31, 2016. The benefit of Government co-contribution for five years under APY will not exceed Rs.5.

Who is eligible for Atal Pension Yojana

To avail the benefits of Atal Pension Yojana, you must fulfill the following requirements:

- Must be a citizen of India.

- Age should be between 18-40 years.

- Must contribute for at least 20 years.

- You must have a bank account linked to your Aadhaar.

- Must have a valid mobile number.

However, those who are availing the benefits of Swavalamban Yojana will automatically be transferred to Atal Pension Yojana.

These documents will be required for APY

The following documents will be required for Atal Pension Yojana:

- Identity Proof (Aadhar Card)

- Address Proof (Voter ID Card, Aadhar Card etc.)

- Documents to verify date of birth (SSLC Certificate)

- Savings Bank Account Number

You must also have an active contact number through which you can receive confirmation and other details.

What are the monthly payments and penalties for APY?

The amount you wish to contribute monthly to the scheme will be automatically debited from your bank account, whether the pension scheme account is opened through a bank branch or online. If you are not able to contribute on time, then a penalty will also be imposed. The penalty amount will be imposed in the following manner:

- If you contribute Rs 100 per month, then Rs 1 per month A fine of Rs will be imposed.

- If you contribute Rs 101 to Rs 500 per month, then Rs 2 per month A fine of Rs will be imposed.

- If you contribute Rs 501 to Rs 1000 per month, then Rs 5 per month A fine of Rs will be imposed.

- If you contribute more than Rs 1001 per month, then Rs 10 per month A fine of Rs will be imposed.

How to withdraw money from APY?

Withdrawals are not allowed from the APY scheme before the age of 60 years, but withdrawals may be allowed in exceptional circumstances such as death or terminal illness of the beneficiary.

- If you turn 60, you are allowed to exit APY with 100% annuitisation of pension wealth. The customer will get pension on exit.

- In case the subscriber dies due to any reason, in this case the pension will be available to his/her spouse and on the death of both of them (subscriber and spouse) the pension amount will be returned to his/her nominee.

How to check APY contribution status

To check the status of your total contribution in Atal Pension Yojana scheme, you can visit the NPS website or login through the mobile app. While logging in you will have to Permanent Retirement Account Number You will have to use your account number, but you can also enter your bank account number while logging in. Follow these steps to track your APY contribution:

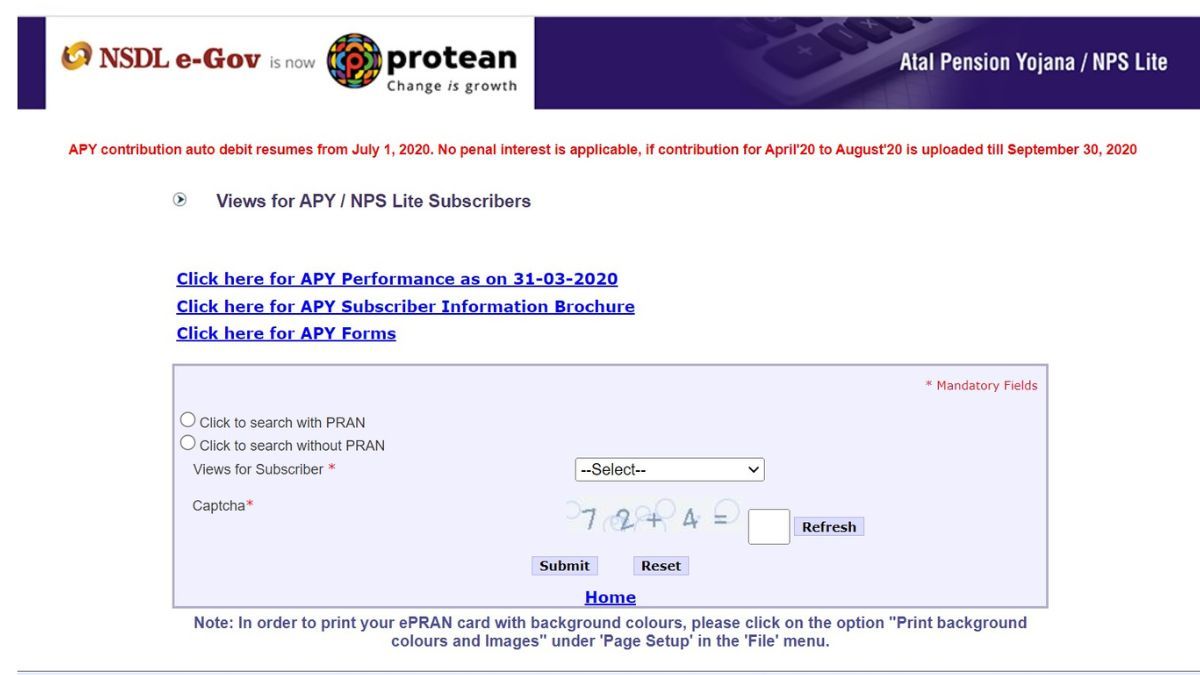

step 1: First of all nps Visit the official website of.

Step-2: then here Transaction Statement View Select the option.

Step-3: After this the page will be redirected. here you PRAN (Permanent Retirement Account Number) You can choose the option with or without it.

Step-4:If you choose the PRAN option, then PRAN details And bank account number Enter.

Step-5: If you have chosen the option without PRAN, then your Name, date of birth and bank account number Enter.

Step-6: Now Transaction Statement View Or APY APY e-PRAN Select.

Step-7: Enter the captcha code, then submit Do it.

if you it APY & NPS Lite If you want to access through the app, you will only need PRAN and registered mobile number to login. For more information related to APY in different languages, click here Click Do it.

in APY How to get monthly pension of Rs 5,000?

To get a monthly pension of Rs 5000, you will have to contribute ₹ 210 to ₹ 1318 per month. In this, maximum nominee return is available up to ₹ 8.5 lakh.

| investment age | investment period | monthly contribution | relative returns |

| 18 years | 42 years | ₹210 | ₹8.5 lakh |

| 25 years | 35 years | ₹376 | ₹8.5 lakh |

| 32 years | 28 years | ₹689 | ₹8.5 lakh |

| 39 years | 21 years | ₹1318 | ₹8.5 lakh |

Questions and Answers (FAQs)

What is the process of opening an account in Atal Pension Yojana?

To open an APY account, the person can contact the bank branch/post office where he has a savings account. If not, then it is necessary to open a savings account.

Can I open an APY account without a savings account?

No, a bank savings account/post office savings account is required to join APY.

Is Aadhaar number necessary to join the scheme?

Atal Pension Yojana (APY) has now been included under Section 7 of the Aadhaar Act. As per the provisions of the Act, any person who is eligible to receive benefits under APY must submit proof of Aadhaar number or get enrolled under Aadhaar authentication. Therefore it is necessary.

How many APY accounts can I open?

Only one APY account can be opened by an individual. Opening of more than one APY account is not permitted.

Can APY account be opened by a minor?

No, APY account cannot be opened by a minor.

I am 40 years old, so can I join Atal Pension Yojana?

No, in the current situation a person who falls in the age group of 18 to 39 years 364 days can join Atal Pension Yojana.

For how many years does one have to freeze money in Atal Pension Yojana?

Under Atal Pension Yojana (APY), one gets a pension of Rs 1,000 to Rs 5,000 every month after turning 60. Anyone between 18 years of age and below 40 years of age can invest in the scheme. You will have to invest for at least 20 years in this scheme (Atal Pension Yojana).

Who can avail the benefits of AALT Pension Scheme?

Any citizen of the country, who is not a taxpayer, can avail the benefit of Atal Pension Scheme run by the government. This rule was implemented last year only in October 2022, before which everyone was eligible to invest in it. Under this scheme, you can get guaranteed pension by making small investments.

How to withdraw money from Atal Pension Yojana?

Any beneficiary of Atal Pension Yojana who wants to withdraw his money or want to close his account will first have to go to his bank/post office where he has opened his Atal Pension Yojana savings account. After reaching the bank branch, you will have to obtain the APY Account Closure form from the bank officer. Then you can deposit it and withdraw the money.

What happens after death in Atal Pension Yojana?

Let us tell you that under Atal Pension Yojana, if the applicant dies due to any accident, illness or any other reason, then in such a situation the amount deposited does not go waste. The pension amount received under the scheme is given to the dependent or spouse of that citizen.

How much money is deducted in Atal Pension Yojana?

As pension amount at the age of 18 years 1000 rupees minimum contribution to get Rs 42 every month While a contribution of Rs. 1454 has to be made. Maximum contribution of Rs 5000 at the age of 40 years. Is for pension amount of Rs.

[ad_2]